Section 179 Bonus Depreciation 2025 For Home. However, as we edge closer to 2025, it’s essential to grasp how these. Section 179 deduction dollar limits.

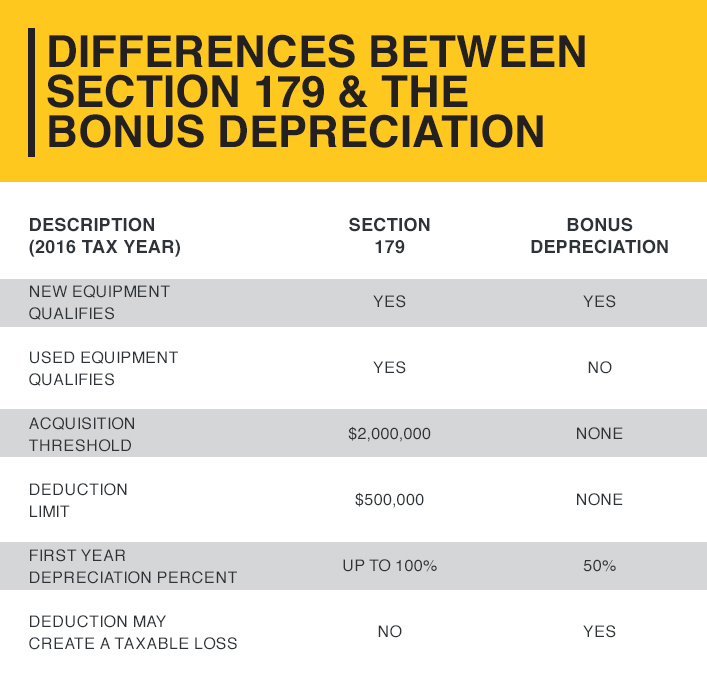

While bonus depreciation and section 179 are both immediate expense deductions, bonus depreciation allows taxpayers to deduct a percentage of an asset’s cost upfront. Bonus depreciation gives taxpayers the ability to expense up to 60% of the cost of assets placed in service during the year for the 2025 tax year.

How to Writeoff Your Equipment Purchases Cleveland Brothers Cat, 7024, which includes 100% bonus depreciation.

Section 179 Bonus Depreciation 2025 Form Almire Fredelia, In 2025, the section 179 deduction limit increases to $1.22 million, with a spending cap on eligible purchases for $3.05 million.

179 Deduction 2025 Jeanne Maudie, It begins to be phased out if 2025 qualified asset additions exceed $3.05.

How Section 179 & Bonus Depreciation Work YouTube, First and foremost, business owners need to have sufficient income to utilize section 179, if they do not, they should use the bonus depreciation deduction.

Tax MACRS Section 179 and Bonus Depreciation, 3 of 3 YouTube, Republican senators blocked from further action thursday the tax relief for american families and workers act of 2025, h.r.

Line 14 Depreciation and Section 179 Expense Center for, A section 179 expense is a business asset that can be written off for tax purposes right away rather than being depreciated over time.

Section 179 Versus Bonus Depreciation Understanding the Differences, Bonus depreciation gives taxpayers the ability to expense up to 60% of the cost of assets placed in service during the year for the 2025 tax year.

Bonus Depreciation vs. Section 179 What's the Difference? (2025), Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket), freeing up $70,000.

Bonus Depreciation Calculator 2025 Nola Terrye, Modified accelerated cost recovery system (macrs) and recognizing recovery periods to use for farm assets differences between general depreciation system (gds).

Section 179 Tax Deduction + Bonus Depreciation Don't miss out, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket), freeing up $70,000.