Simple Ira Limits 2025 Over 50. Employees 50 and older can make an extra $3,500. You can make 2025 ira contributions until the.

For 2025, you can contribute as much as $7,000 to an ira or $8,000 if you’re age 50 and older. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

Ira Limits 2025 Catch Up Debi Charleen, Increased simple plan contributions for. An employee cannot contribute more than $16,000 in 2025 ($15,500 in 2025) to a simple ira.

2025 Roth Ira Contribution Limits Calculator Sally Karlee, The simple ira and simple 401(k) contribution limits will increase from $15,500 in 2025 to $16,000 in 2025. Employees 50 and older can make an extra $3,500.

Max Simple Ira Contribution 2025 Over 50 Rowe Rebeka, The 2025 simple ira contribution limit for employees is $16,000. You can make 2025 ira contributions until the.

2025 Roth Ira Contribution Limits Over 50 Clair Demeter, Employees age 50 or over. You need taxable compensation (“earned income”) to contribute to a traditional or roth ira but there’s no age limit.

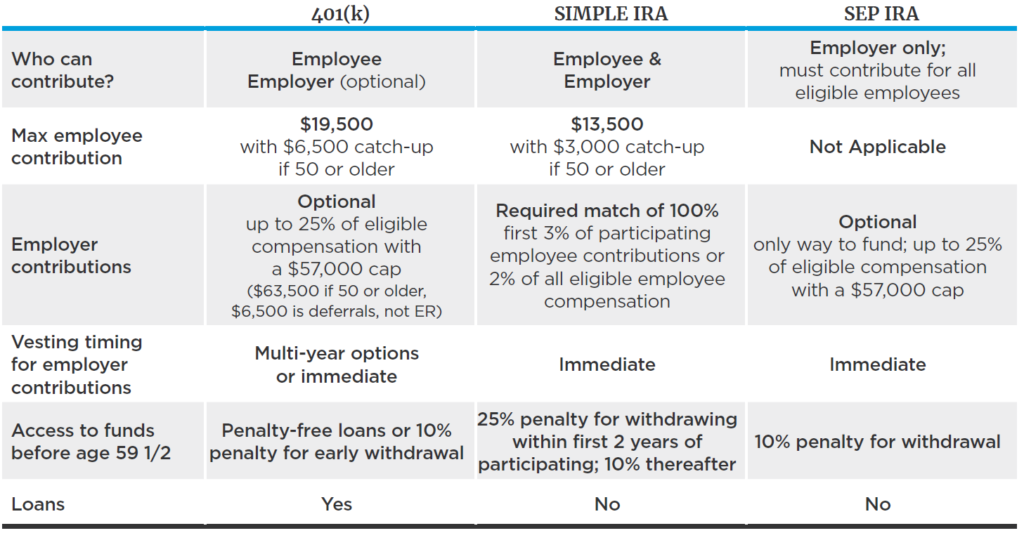

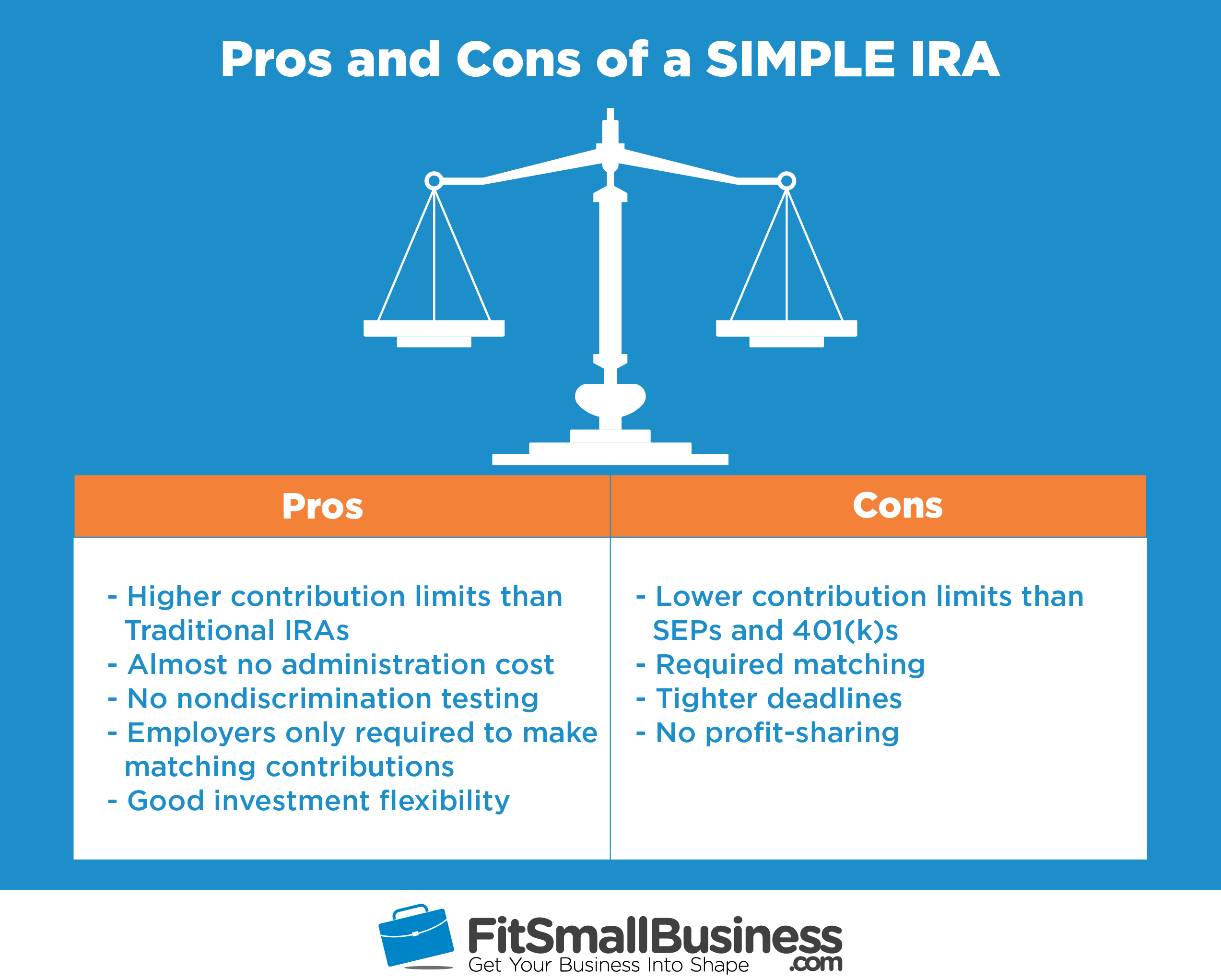

Simple Ira Contribution Limit For 2025 Alys Marcellina, The simple ira and simple 401(k) contribution limits will increase from $15,500 in 2025 to $16,000 in 2025. Contribution limits for simple ira plans are lower than other workplace retirement plans, such as a 401(k) plan.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, In 2025, the contribution limits were $6,500, or $7,500 for taxpayers who are 50 or older. The simple ira contribution limit for employees in 2025 is $16,000.

What Are The Ira Limits For 2025 Margo Sarette, The traditional ira or roth ira. The higher limit for individuals aged.

401k Limits For 2025 Over Age 50022 Over 55 Sonia Eleonora, Your total contributions to traditional or roth iras are limited to $7,000 in. In 2025, employees, sole proprietors, and self.

2025 Limits For Traditional Ira Clair Demeter, Employees 50 and older can make an extra $3,500. The simple ira and simple 401(k) contribution limits will increase from $15,500 in 2025 to $16,000 in 2025.

Simple Ira Employer Contribution Limits 2025 Farica Mariele, This article provides a comprehensive overview of the current limits for individuals and employers. Your total contributions to traditional or roth iras are limited to $7,000 in.

You need taxable compensation (“earned income”) to contribute to a traditional or roth ira but there’s no age limit.